Are you trying to make sense of all the data out there and how to use it to make important decisions? Don't worry, we've got you covered!

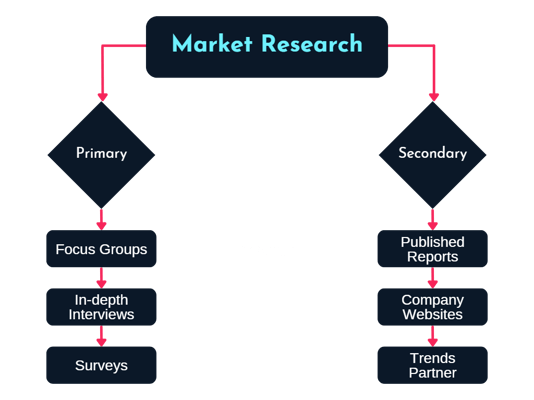

When we talk about market research, we're really talking about collecting data. But data sources can be split into two main categories: primary and secondary. Which type is best to help you make important decisions for your business?

Primary research is your typical market research: it involves collecting original data firsthand, such as through surveys, interviews, or experiments. Secondary research analyzes existing data collected by others--trusted work that has already been done.

Before you start designing that consumer survey, it's a good idea to check out secondary sources to see if anyone else has already answered some or all of your questions. This data is either publicly available or relatively cheap to access and can serve as the foundation for any analysis or business decision.

Where to Find Secondary Sources

- Industry associations:

These groups often share valuable information on their websites, including industry overviews and product and company news.

Keep in mind that industry data typically only covers a certain share of overall activity, so you'll need to do some extra digging to see the whole picture. These sources can be great for market sizing and identifying trends and key players. - Company websites:

Public companies often have investor relations sections on their websites that are full of reports and other investor documents. Private companies aren't required to report as much information, so you might not get as much detail. These sources can be great for market sizing, market share analyses, and more. - Government statistics:

These are widely available online and cover a wide range of topics, like product shipments, patents, inflation, and more. They can be helpful for market sizing and identifying trends. Just be prepared to do some extra analysis to get the data in a format that works for you. - Published market research reports: These reports (for a fee) can provide an overview of an industry, including quantitative data on market size, growth rates, and market share for industry players. They might be a bit broad, though, so if you're looking for more specific details on product segments or geographies, you might need to look elsewhere. These reports can be helpful for market sizing and market share analyses. Statista and ReportLinker are two great resources. (Disclaimer: some of these require fees or subscriptions)

- Trade publications:

Periodicals and news articles (many of which are online) can be a great source of information on specific industries and companies. Just be aware that they might not always provide the most up-to-date information. These sources can be great for identifying key players and industry trends.

How to Approach Primary Data

Primary data is information that is collected specifically for your needs, directly from people who are part of the industry you're studying. There are a few different ways you can gather primary data, and the method you choose will depend on your research goals and the level of detail you're looking for. These include:

- Focus groups:

These allow companies to get specific feedback (qualitative data) from small groups of end-users on a new product or service that's still in development. Just keep in mind that unless you conduct multiple focus groups and compare responses, you might have issues with sampling error. Focus groups can give you valuable insights on what end-users like and dislike about a new offering. - In-depth interviews:

These allow you to get detailed qualitative and quantitative information from key industry experts. They can also lead to new paths of examination that come up naturally during the conversation. Just be aware that you'll need extensive contacts within the industry and experience engaging with experts to conduct in-depth interviews effectively. In-depth interviews can give you valuable insights from leading industry players on their business, competitors, and the industry as a whole. - Social media monitoring:

This allows you to gather data passively by observing conversations on social media. Just be aware that you won't be able to ask follow-up questions or probe further if you have questions about why someone is saying something. Social media monitoring can give you insights on how much people are talking about your brand compared to competitors, whether the conversation is positive or negative, and more. We like to use Brandwatch. - Surveys:

These are a great way to collect large amounts of representative quantitative data through primary research methods. Just be aware that surveys are static and don't allow for follow-up questions or further probing. It's also important to carefully develop the questions you'll use in your survey to ensure its success. Surveys can give you insights on who a given population is, what they do, what they like, and more.

The amount of data out there is overwhelming--but we can help. MDRG does both primary and secondary research for many of our projects to ensure that our research findings are in line with current industry trends.

If you need help sorting through your data, or figuring out the best way to collect information, contact us.

Are you eager to stay ahead of the curve in your industry? Sign up for our monthly insights email and gain exclusive access to valuable market research, industry trends, and actionable recommendations delivered directly to your inbox.

Topics from this blog: Market Research Research Methods