Healthcare is in an age of organizational disruption and consumer choice. Health systems are challenged to respond to the fragmentation of the relationship between provider and patient given the emergence of retail disruptors.

Enter the Healthcare Experience (HX) Index, MDRG’s most recent syndicated report.

Why Did MDRG Create The HX Index?

Many consumers today can enjoy a better, more personalized, and more convenient primary healthcare experience than they could have in the past. This new consumer experience stems from the advent of factors such as telehealth, health and wellness apps, nutrition research, and emerging services from healthcare disruptors like ZocDoc, CVS Minute Clinic, and Walmart Health. However, the exact role of these factors in consumers’ lives – as well as their importance – is still not well understood. We wanted to be able to help shed some light on these issues for our clients and ourselves.

In short: We are curious.

After almost 30 years of working in healthcare, the unprecedented fragmentation in primary care has had a big impact on our clients and the focus of our work. We wanted to understand more about what the disruptors would do to the relationship between health systems and their patients. If we can get ahead of our clients’ concerns, we will be armed with data to help them navigate these changes.

Understanding America: Survey Design

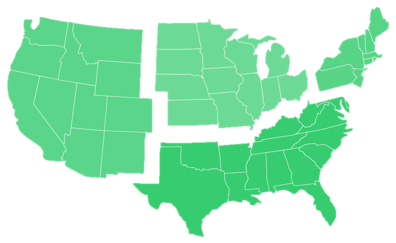

We designed the survey with a national lens. The 1,000 respondents were equally distributed from across the continental United States, do not work in healthcare or market research, have utilized a primary care provider (PCP) in the prior two years, have commercial health insurance or Medicare (Supplement or Advantage), and are 18 years or older. Fielding took place in Q3 of 2023.

Some of the questions we wanted to answer include:

- How do consumers utilize these new dimensions to healthcare?

- What qualities most influence the overall healthcare experience?

- How will this shape the future for more traditional primary care providers?

What We Found Surprised Us

We expected to see a very clean delineation where people who are using nontraditional healthcare are driven exclusively by convenience. Our initial hypothesis was that making healthcare easier and more accessible was the only thing that mattered to patients using disruptors.

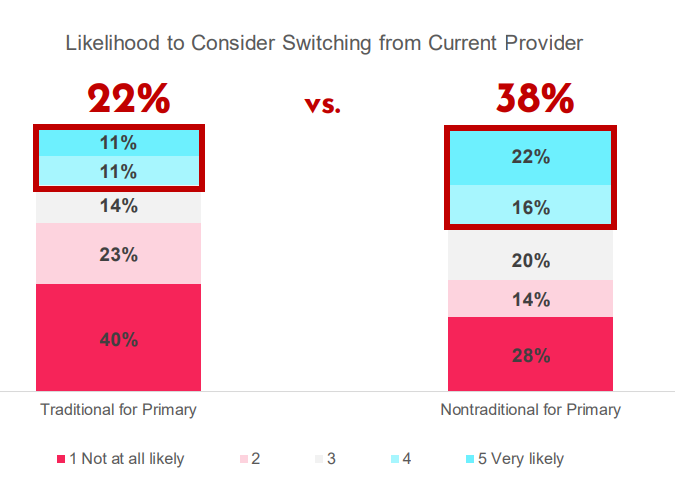

Our national survey showed us something a little different. What we saw was that people really value quality in healthcare, even for low-acuity services like primary care. When it comes to their health, patients are not willing to sacrifice quality for the sake of convenience.

But it gets even more interesting: nontraditional providers aren’t always viewed as low quality. Depending on the severity and immediacy of the medical concern, nontraditional providers can meet patients’ expectations for quality. Traditional providers need to find ways to compete in lower acuity / more routine circumstances to gain or maintain this customer base.

To read the report and see topline findings, visit our website.

What’s Next?

Not only do we have a snapshot of the current healthcare industry, but we’ve laid the groundwork for long-term and in-depth understanding of the forces reshaping it. We have good baseline data that's starting to tell a story and can keep up with this data over time to see the way consumers are migrating to different solutions--or not.

These changes—the ones that have instigated, removed barriers for, or become the disruptors—are not done. The consolidation in health insurance and health systems is making way for new entrants and providing patients with new options. As this occurs it will be more important than ever to keep our finger on the pulse.

How Healthcare Companies Can Use HX Index

Our HX index gives healthcare companies a view, by region and by demographic, of the way that consumers are feeling about health systems versus nontraditional healthcare providers. Knowing what drives patient decision-making develops a better understanding of which levers they can pull to remain relevant in the industry and maintain their patient base.

As patient needs continue to shift, strategy will need to shift with it. This can look different depending on the health system and the consumer, so the HX Index data can help unravel the complexities behind what’s driving patient behavior.

We understand these dynamics well and can provide a custom approach to help you understand your patients and how your healthcare company can best navigate the shifting market landscape.

Contact us to start a conversation about how the HX Index can help your business thrive.

Access the report here, or contact us to learn more.

Are you eager to stay ahead of the curve in your industry? Sign up for our monthly insights email and gain exclusive access to valuable market research, industry trends, and actionable recommendations delivered directly to your inbox.

Topics from this blog: Customer Experience Market Research Healthcare